child tax credit 2021 dates direct deposit

Under the enhanced CTC families with children under 6 received a 3600 tax credit in 2021 with 1800 of that sent via the monthly checks or 300 per month. Eligibility Rules for Claiming the 2021 Child Tax Credit on a 2021 Tax Return.

Tds Income Tax Return Itr Due Dates Income Tax Return Tax Deducted At Source Income Tax

If Married Filing Jointly If Letter 6419 Has a Different Advance Payments Total.

. Do not call the IRS. 15 opt out by Nov. The IRS will pay 3600 total per child to parents of children up to five years of age.

To reconcile advance payments on your 2021 return. However the refundability of the credit is limited similar to the 2020 Child Tax Credit and Additional Child Tax Credit. If your direct deposit information is up to date but you still got a paper check.

Payments begin July 15 and will be sent monthly through December 15 without any further action required. 29 What happens with the child tax credit payments after December. For now parents of about 60 million children will receive direct deposit payments on October 15 while some may receive the checks.

Any updates made by August 2 will apply to the August 13 payment and all subsequent monthly payments for the rest of 2021. The IRS will pay 3600 per child to parents of young children up to age five. Advance Child Tax Credit payments are early payments from the IRS of 50 percent of the estimated amount of the Child Tax Credit that you may properly claim on your.

Businesses and Self Employed These FAQs were released to the public in Fact Sheet 2022-28 PDF April 27 2022. The 2021 child tax credit payment dates along with the deadlines to opt out are as follows. 2021 Advance Child Tax Credit Payments start July 15 2021 Eligible families can receive advance payments of up to 300 per month for each child under age 6 and up to 250 per month for each child age 6 and above.

Refund payments held up the PATH act are now processing in batches and the latest status should be available by February 19th with payments via direct deposit being made by March 1st per the IRS. July 16 2021 307 PM MoneyWatch About 35 million US. The American Rescue Plan increased the Child Tax Credit to 3600 for qualifying children under 6 and 3000 for qualifying children 6-17.

15 opt out by Aug. Benefit payment dates - Canadaca Benefit payment dates Canada child benefit CCB Includes related provincial and territorial programs All payment dates January 20 2022 February 18 2022 March 18 2022 April 20 2022 May 20 2022 June 20 2022 July 20 2022 August 19 2022 September 20 2022 October 20 2022 November 18 2022 December 13 2022. It also made the parents or guardians of 17-year-old children newly eligible for up to the full 3000.

The estimated tax season refund payment dates schedule is based on past refund cycles and IRS guidelines. Half of the money will come as six monthly payments and. That changes to 3000 for each child ages six through 17.

13 opt out by Aug. You can also refer to Letter 6419. Families with 60 million children were sent the first monthly check for the Child Tax Credit on July 15.

15 opt out by Nov. Child Tax Credit Update Portal to Close April 19 This portal closes Tuesday April 19 at 1201 am. 15 The payments will be made either by direct deposit or by paper check depending on what information the IRS has on file.

Added June 14 2021 A1. Enter your information on Schedule 8812 Form 1040. Get your advance payments total and number of qualifying children in your online account.

What are advance Child Tax Credit payments. Department of the Treasury issued approximately 216 million expanded Child Tax Credit payments to 36 million households covering over 61 million children. The rollout of funds for the expanded child tax credit began on July 15 with the IRS sending out letters to 36 million families it believed to.

From July 2021 to December 2021 the US. The American Rescue Plan Act ARPA of 2021 expanded the Child Tax Credit CTC for tax year 2021 only. For more information see Q B7 in Topic B.

Families will receive their July 15 payment by direct deposit in the bank account currently on file with the IRS. President Biden has proposed extending the enhanced Child Tax Credit including monthly payments for at least 2022. Katie Teague 7212021.

Find the total Child Tax Credit payments you received in your online account or in the Letter 6419 we mailed you. IR-2021-153 July 15 2021 WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families have started receiving monthly Child Tax Credit payments as direct deposits begin posting in bank accounts and checks arrive in mailboxes. These Child Tax Credit frequently asked questions focus on information needed for the tax year 2021 tax return.

15 opt out by Oct. The remaining 1800 will be claimed. It also provided monthly payments from July of 2021 to December of 2021.

The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600 per qualifying child. 7 While these are impressive numbers it is not immediately clear what share of eligible households actually received the payments. Here are the official dates.

You need that information for your 2021 tax return. The bank account update feature was added to the Child Tax Credit Update Portal available only on IRSgov. If youd rather receive your.

Best South African Birth Certificate Template Birth Certificate Template Certificate Templates Birth Certificate

Tds Income Tax Return Itr Due Dates Income Tax Return Tax Deducted At Source Income Tax

Pin On 529 College Savings Plan Board 529 Plans

Modified Scheme Of Tax Collection For Salaried Employees Cbdt Sag Infotech Tax Deducted At Source Budgeting Tax

Public Notice Update Banking Information To Get Reverse Tax Credit Barbados Today Tax Credits Motivational Skills Banking

Https Cdn Shopify Com S Files 1 0515 1417 9779 Products Screenshot 1 D28cdc78 9341 4d4c Aa46 D6462c7673cf 750x Statement Template Bank Statement Sutton Bank

Minnesota W4 Form 2021 W4 Tax Form Federal Income Tax Payroll Taxes

W 2 User Interface W 2 Wage And Tax Statement Data Is Entered Onto Windows That Resemble The Actual Forms Imports Employee Informa Irs Forms W2 Forms Irs

Bankruptcy Chapter 13 Chapter 13 Financial Management Chapter

Best Tax Free Bonds To Invest In 2020 Tax Free Bonds Tax Free Investing

Fresh Blank Business Check Template Word Payroll Template Business Checks Paycheck

New Online Tax Exempt Organization Search Https Www Irstaxapp Com New Online Tax Exempt Organization Search Online Taxes News Online Organization

Tds Due Dates October 2020 Dating Due Date Income Tax Return

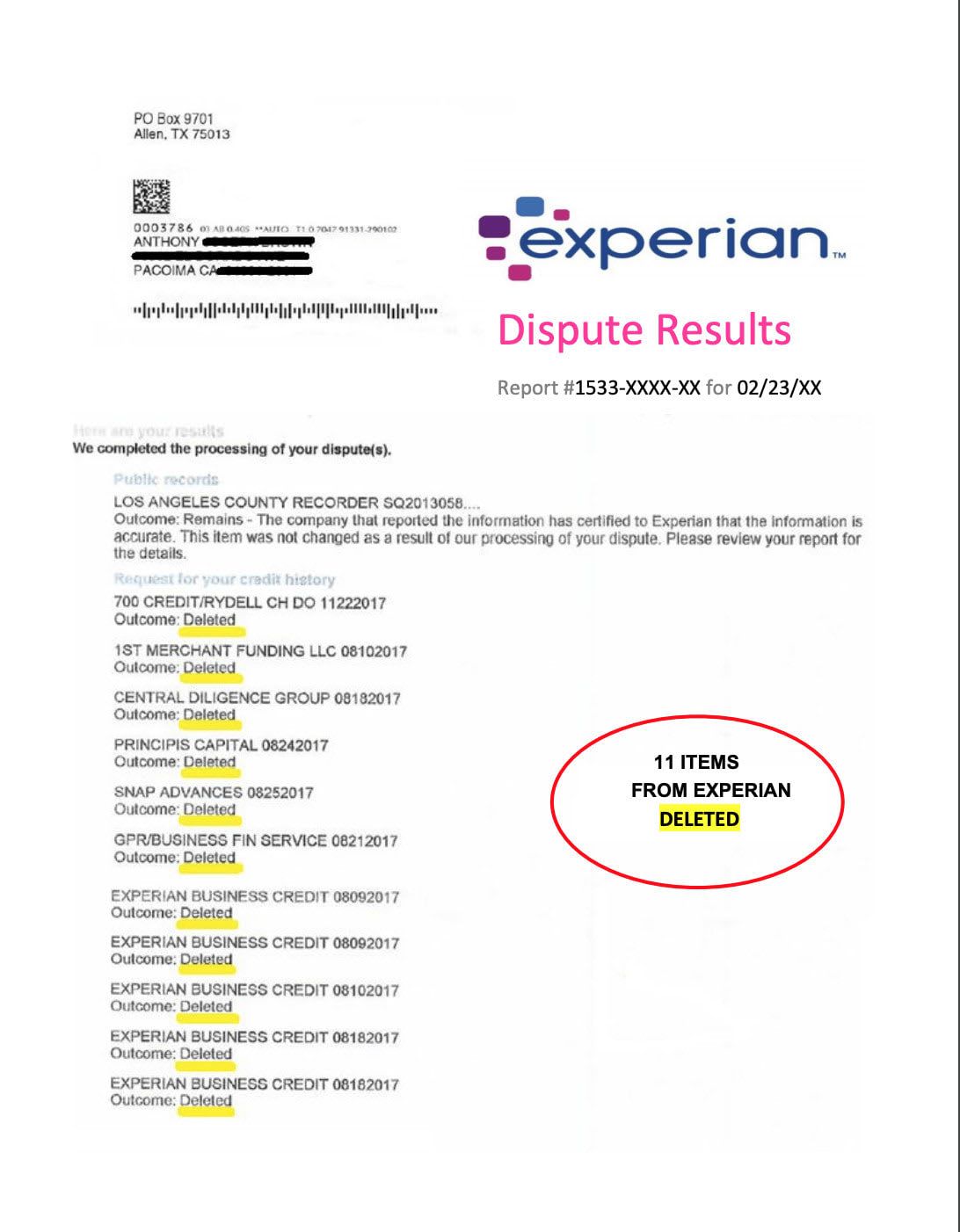

Find The Best Global Talent Dispute Credit Report Credit Dispute Letter Templates Free